Support the Homer Fund

Donations to The Homer Fund are used to support thousands of Home Depot associates enduring an unforeseen event causing a financial hardship. Please consider a donation to support the ongoing efforts to provide essential necessities to associates in need.

CLICK HERE to support your fellow associates via payroll donation

(one-time payroll donations have a $10 minimum)

CLICK HERE to support your fellow associates via credit card donation

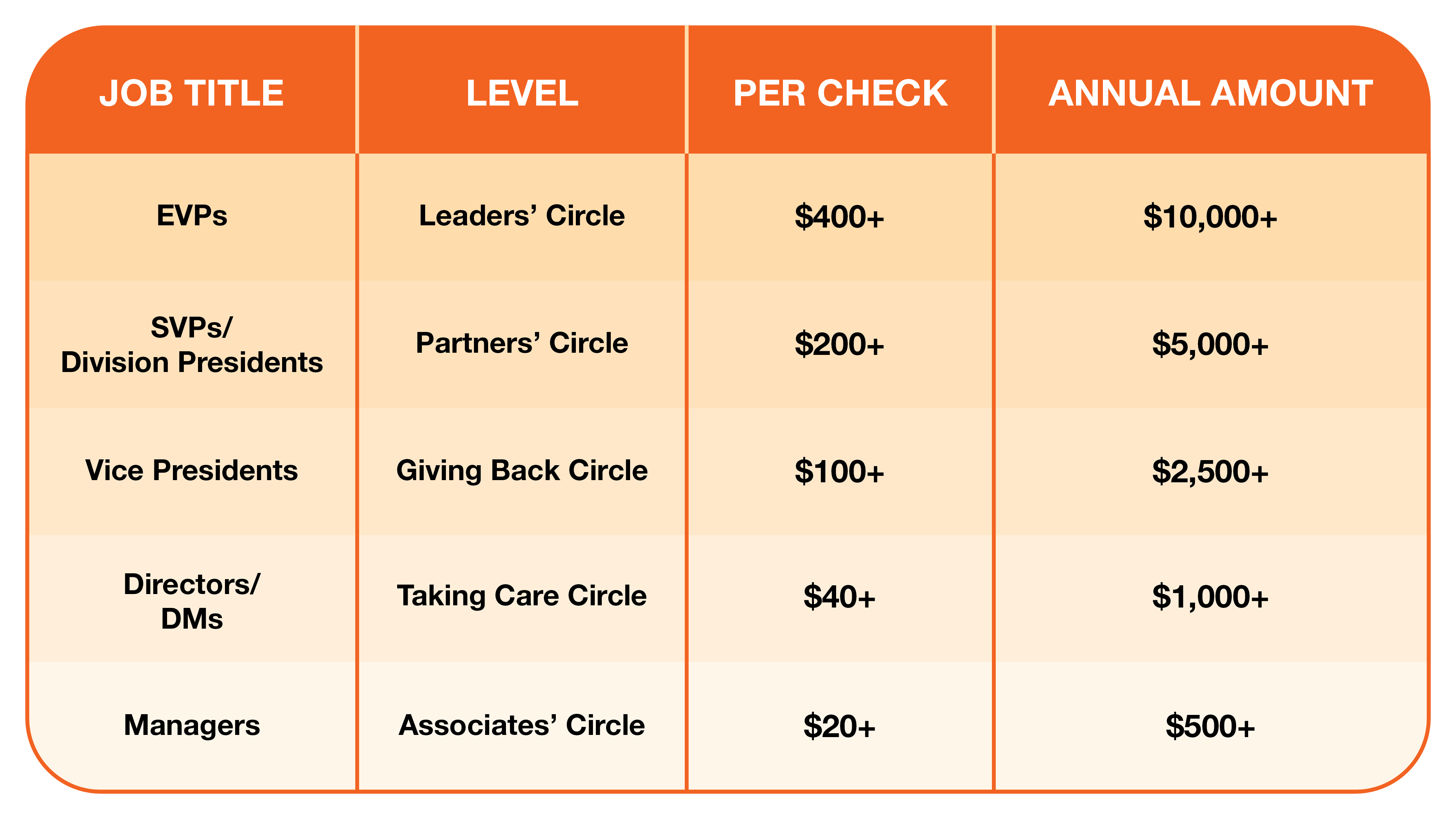

Review our suggested levels of giving below:

ASSOCIATES MAY DONATE TO THE HOMER FUND THROUGH THE FOLLOWING METHODS:

- Automatic payroll donation

- PLEASE NOTE: In order to sign up for automatic payroll deductions, you will need your Home Depot username and password.

- This link is also used to CHANGE OR MANAGE the amount you currently donate to the Fund. By re-enrolling for automatic payroll donations, your previous donation amount will be cancelled and the new amount specified will be deducted from your paychecks going forward. Please allow 1-2 pay cycles for the change to be reflected on your paycheck.

- Recurring payroll donations will continue until cancelled. To cancel, you will need your 9-digit Associate Identification Number (AIN). Please email The Homer Fund staff at Homer_Fund@HomeDepot.com or call at (770) 384-2611 with your request to cancel.

- One-time payroll donations have a minimum donation of $10.

As a 501 (c)(3) charity, The Homer Fund relies on donations from associates to help carry out its mission. By donating to the Fund, you can feel confident that:

- Donations made to The Homer Fund are voluntary

- Your financial gift goes directly to associates in need of shelter, food, clothing, funeral expenses and other essential qualifying expenses

- Your donation is tax-deductible (federal tax ID #58-2491657)

- One-time payroll deductions have a minimum of $10

- An annual total of $3 million received from The Home Depot Foundation's Associate Matching Gifts Program helps to fund overhead costs (payroll, fundraising and office expenses) and other programs offered (i.e., scholarships).